What Is Risk Management in Trading?

Before making consistent profits, traders must first master the art of not losing. That’s where risk management in trading comes in. It’s the process of identifying, assessing, and controlling the risk of loss in each trade you make.

In simple terms: Risk management is how you protect your capital. Whether you’re into intraday, swing, or option trading, proper trade and risk management is what keeps you alive when markets turn against you.

Why Most Traders Fail Without Risk Management

- They don’t use stop-loss orders

- They overtrade during emotional highs/lows

- They increase lot size after a loss, chasing profits

- They risk too much on one trade

Losses are part of trading. But letting one trade wipe out your account is a choice and one proper risk management helps you to avoid that.

Practical Example: Think of it like cricket, you don’t need to hit sixes on every ball. Play defensively when needed to stay in the game.

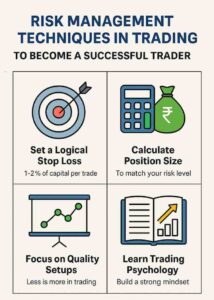

Top Risk Management Techniques Every Trader Must Use

✅ 1. Use a Fixed Percentage Risk per Trade

One of the most basic but effective risk management techniques is to never risk more than 1–2% of your total capital on a single trade.

Example: If you have ₹50,000 capital, the risk per trade should not exceed ₹1,000.

Real-Life Perspective: If you take 10 trades and win 5 of them with ₹2,000 profit per win and ₹1,000 loss per loss:

- Profit: ₹10,000 (₹2,000 x 5)

- Loss: ₹5,000 (₹1,000 x 5) ➡️ Still in profit: ₹5,000. Even if you win just 4 trades out of 10, you’re still profitable. This shows quality > quantity.

✅ 2. Set a Logical Stop Loss – Not an Emotional One

One of the golden rules of risk management in trading is to never risk more than 1-2% of your total capital on a single trade — no matter how confident you are.

This isn’t about support or resistance zones. This is about protecting your capital over the long run. Emotional decisions like doubling down on a losing trade or widening your stop-loss to “wait for a bounce” can destroy your account.

Example:

If you have ₹1,00,000 in your trading account, the maximum risk per trade should be ₹1,000 to ₹2,000.

This way, even if you hit 5 losses in a row, you still have 90%+ of your capital safe and can bounce back.

Treat stop-loss as your “tuition fee” to the market, it’s the cost of staying in the game.

✅ 3. Know Your RRR – Risk to Reward Ratio

Aim for a minimum Risk: Reward Ratio of 1:2 or higher. This means if you risk ₹1,000, your target should be at least ₹2,000.

Example Breakdown:

- If you take 10 trades with 1:2 RRR,

- And you win only 4 trades (40%)

- You’ll make ₹8,000 (₹2,000 x 4)

- You’ll lose ₹6,000 (₹1,000 x 6) 👉 Still net profit: ₹2,000

Moral: Focus on quality over quantity. Even fewer winning trades can lead to profit with proper Risk to Reward Ratio (RRR).

✅ 4. Use a Daily Loss Limit

If you hit a daily loss limit (say 3%–5% of your capital), stop trading for the day.

This prevents revenge trading and protects you during choppy or irrational market days.

Trading Psychology Tip: Walking away after a loss takes discipline, but it protects your confidence and capital.

✅ 5. Intraday Trading Risk Management: Be Extra Disciplined

Intraday trading is fast and risky. Here’s how to stay safe:

- Trade fewer setups, with tighter SLs

- Avoid over-leveraging

- Don’t trade during major news events unless you’re experienced

- Book profits quickly — the trend changes fast intraday

Visual Tip: Imagine trading intraday like driving a race car. One wrong turn without a seatbelt = game over. Risk control is your protection.

✅ 6. Risk Management in Option Trading: Manage Decay & Volatility

Risk management in option trading is more complex due to time decay (theta) and volatility spikes.

Smart option traders:

- Use defined-risk strategies (like spreads or hedging)

- Avoid holding naked options overnight

- Adjust position sizing according to implied volatility

- Don’t blindly buy options with low capital expecting high returns

🔍 Example: Buying a ₹100 option that expires in 2 days might look cheap, but if it doesn’t move quickly, time decay can eat your entire investment.

✅ 7. Accept Losses. They Are Part of the Game

Don’t take it personally when a trade hits SL. Even pro traders lose money. The key is controlling the loss and sticking to your plan.

Trading Psychology Reminder: Focus on long-term consistency, not short-term wins. Let your system do the work, your job is to follow it.

📚 Best Books to Learn Risk Management Like a Pro

1. “Trading in the Zone” by Mark Douglas (Mindset Game-Changer)

Focuses on the psychology of trading and risk perception

Helps you understand:

- Why traders make emotional decisions

- How to build discipline and consistency

- The mindset of consistently profitable traders

✅ Best for: Traders struggling with fear, greed, and overtrading

Your brain is your best trading tool. This book teaches you how to use it right.

Pages: 240

2. “The Risk of Trading” by Michael Toma (Highly Recommended)

Laser-focused on real-world risk management for professional and retail traders

Covers:

- Position sizing

- Drawdown control

- Portfolio exposure

- Risk metrics like Risk of Ruin and Monte Carlo simulations

✅ Perfect for traders who want to build a solid, technical risk management framework

💡 A must-read if you’re ready to treat your trading like a business, not a gamble.

Pages: 224

3. “Come Into My Trading Room” by Dr. Alexander Elder (Complete Trader’s Blueprint)

A practical and well-structured book that combines risk management, psychology, and technical analysis — all in one. Dr. Elder literally invites you into the mindset, routine, and risk approach of a professional trader.

You’ll learn:

• How to manage risk through position sizing and discipline

• How to avoid emotional trading traps

• How to build a trading plan with rules for entries, exits, and risk control

• The “3 M’s” of trading: Mind, Method, and Money

Pages: 208

Conclusion

Most people jump into trading thinking only about profits. But the real traders focus on how not to lose. Whether you’re a beginner or someone struggling with consistency, mastering these risk management techniques will be the foundation of your success.

No matter what strategy you follow, always ask yourself before entering a trade:

How much am I willing to lose?

If you don’t know the answer, don’t take the trade.